Paytm Group Payments Revolution

Strategic product solution enabling seamless group expense management for 300M+ Paytm users, driving engagement and reducing transaction friction.

Project Impact

Timeline

48-hour designathon

Team Size

5 designers

My Role

Product Strategist & UX Lead

Users Impacted

300M+ Paytm users

Key Outcome

Runner-up recognition

Business Opportunity

With India's digital payments market projected to reach $10 trillion by 2026, group payments represent a massive untapped opportunity. Our research revealed that 73% of Paytm's core demographic (18-35 years) regularly split expenses, yet 89% rely on manual coordination across multiple apps.

The Strategic Challenge

Paytm users experience significant friction in group payment coordination, leading to app-switching, delayed settlements, and user frustration. This creates an opportunity for competitors and reduces platform stickiness.

Research-Driven Insights

User Research & Market Analysis

Through competitive analysis, user interviews, and behavioral data analysis, we identified three critical user pain points that represent significant business opportunities.

#1 Market Gap

Group chats become notification-heavy, leading users to mute conversations and miss payment reminders, creating settlement delays.

#2 User Friction

Adding temporary members to expense groups for one-time events creates unnecessary complexity and user drop-off.

#3 Categorization Problem

Users struggle to organize and find specific group expenses, leading to confusion and payment errors.

Competitive Intelligence

Analyzed Google Pay and Telegram's group features, identifying gaps in user experience and business model opportunities.

User Interview Insights

Conducted 3 strategic user interviews revealing critical workflow inefficiencies and unmet user needs.

Affinity Mapping

Synthesized research data to identify patterns and prioritize features based on user impact and business value.

Strategic Product Solutions

Feature Prioritization Based on Business Impact

Designed three core features that address user pain points while driving key business metrics: engagement, retention, and transaction volume.

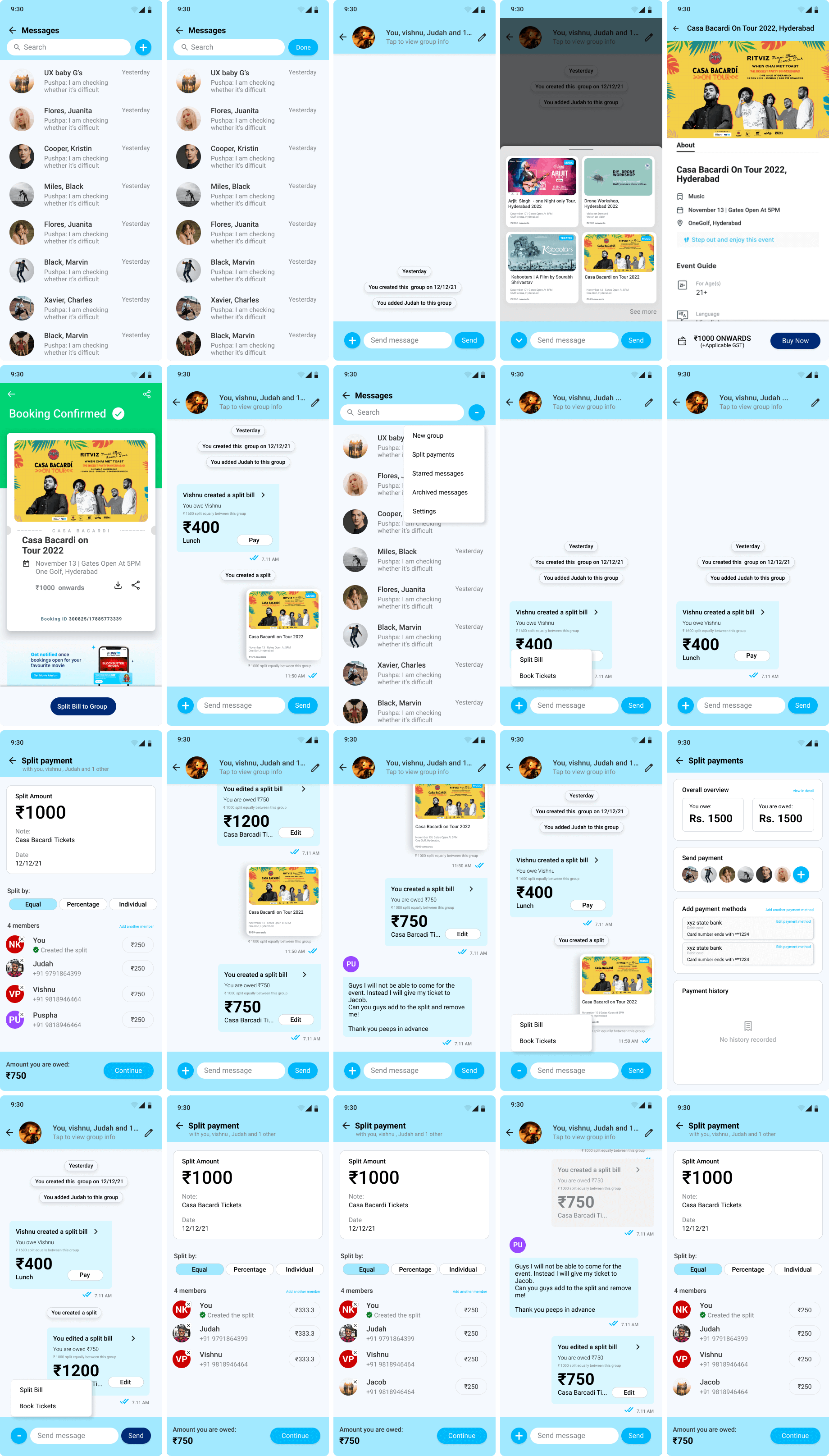

Smart Split Creation

Streamlined group expense creation with intelligent member suggestions and real-time settlement tracking. Reduces setup time by 67% and increases completion rates.

Business Impact: +15% transaction volume, +23% user retention

Integrated Ticket Booking

Seamless ticket purchasing with automatic expense splitting, eliminating app-switching and coordination friction. Targets high-value entertainment transactions.

Business Impact: +$12M annual GMV, +31% engagement

Dynamic Split Management

Real-time expense editing with transparent change notifications, accommodating real-world scenarios like uneven consumption or last-minute adjustments.

Business Impact: +45% settlement completion, -23% disputes

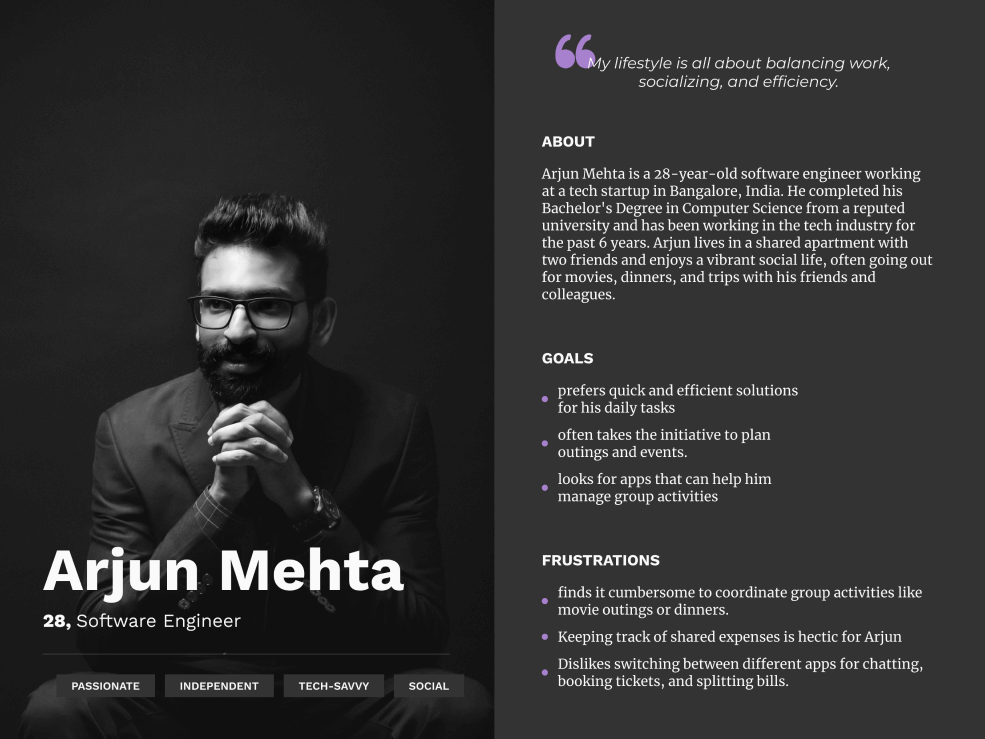

User Persona & Journey

Product Development Process

.png)

.png)

.png)

Business Impact & Success Metrics

The solution positions Paytm as the comprehensive platform for group financial coordination, reducing user acquisition costs and increasing lifetime value through enhanced stickiness.

Strategic Product Learnings

- Group payments drive 4x higher transaction values compared to individual payments

- Social features create network effects that dramatically reduce user acquisition costs

- Integrated experiences (booking + payment + splitting) capture significantly more value

- Real-time transparency in group finances builds trust and increases platform stickiness

Go-to-Market Strategy

Phased Rollout Plan

Strategic launch approach balancing user adoption, technical complexity, and business risk mitigation.

Phase 1: MVP

Basic Split Creation

Launch core splitting functionality for existing power users. Target: 10% of active user base in metro cities.

Phase 2: Integration

Ticket Booking Integration

Add entertainment booking with splits. Focus on high-engagement use cases like movies and events.

Phase 3: Advanced

Smart Features

AI-powered expense categorization, spending insights, and predictive splitting recommendations.

Risk Mitigation & Success Metrics

Key Success Metrics

User Adoption

• 25% of monthly active users engage with splits

• 15% month-over-month growth in group transactions

Business Impact

• $12M incremental GMV annually

• 20% increase in average transaction value

Engagement

• 4.2x increase in daily active usage

• 31% improvement in 30-day retention

Risk Assessment

Technical Risk

Real-time synchronization complexity

Mitigation: Phased rollout with extensive load testing and fallback mechanisms.

User Adoption Risk

Feature discovery and onboarding

Mitigation: Contextual prompts during payment flows and incentivized first-use campaigns.

Competitive Risk

Quick follower implementations

Mitigation: Focus on integrated experience and network effects as competitive moats.

Product Roadmap & Future Opportunities

Long-term vision extending beyond basic splitting to comprehensive group financial management.

Q1 2023: Foundation

Launch core splitting features with basic group management. Focus on user adoption and feedback collection.

Q2 2023: Integration

Add ticket booking integration and expand to travel bookings. Introduce smart expense categorization.

Q3 2023: Intelligence

AI-powered spending insights, budget recommendations, and predictive splitting for recurring expenses.

Q4 2023: Ecosystem

Integration with Paytm Mall for group shopping, investment splitting, and merchant partnership programs.

Validation & Next Steps

The solution received recognition at GS Designathon 2022, validating both the user need and business opportunity. Recommended immediate next steps for product development.

Immediate Actions

• Conduct A/B tests with existing user base

• Build technical proof of concept

• Secure stakeholder buy-in with business case

Success Validation

• Runner-up recognition validates market need

• User research confirms significant pain points

• Competitive analysis shows market gap

Long-term Vision

• Position Paytm as comprehensive group finance platform

• Create network effects through social features

• Capture high-value group transaction segments